Integration into Existing Management Systems and IT-Systems

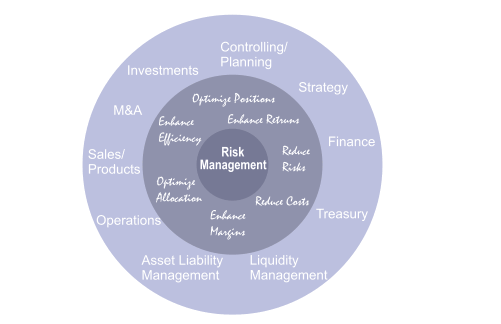

Integrating the Risk Dimension into Existing Management Systems

Conventional planning and management systems have been based solely on costs/expenses and earnings/profit without adequate consideration of the risk dimension. Nowadays companies want to understand and quantify the risk contributions in planned incomes and cash flows to reduce uncertainties, to obtain a clearer picture of possible future developments, and to save on the premia associated with risk. Financial services were the first to incorporate the risk dimension into their businesses and today risk-return based performance metrics are the only universally accepted benchmarks in financial markets.

Noetzold & Noetzold has developed an efficient and successful concept for an enterprise-wide integration of the risk dimension into management systems and processes (e.g. in operative and strategic planning, controlling) of corporates. Objective is an enterprise-wide coherent and consistent valuation of asset, risks, and risk premia based on common risk management data and market data. This objective is reached by providing the valuation, benchmarking, and data services through a central globally accessible enterprise-wide risk management system.

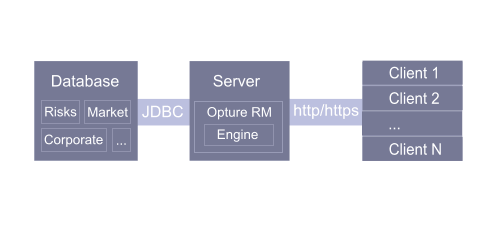

State-of-the-art System Architecture

The corporate risk management system Opture® (Optimize the Future) is a complete risk management platform with risk database, server, and risk engine. The platform was designed to be stable, scalable, flexible, secure, and user-friendly. The implementation as web application (intranet) met these requirements best. Due to its architecture and interfaces, the Opture® system can be easily and efficiently integrated with existing systems. Noetzold & Noetzold employees are experienced experts in system integration and implementation and with track records covering many business sectors.