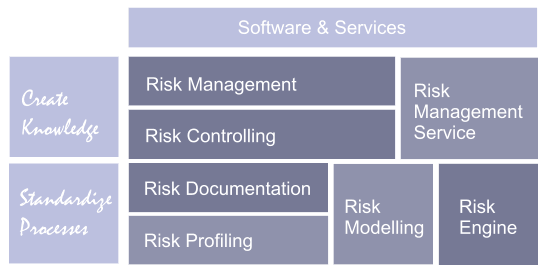

Modularly Upgradeable Risk Management System

Gradual Development of Risk Management Systems

Noetzold & Noetzold provides innovative and best-practice enterprise-wide risk management systems and risk management services. The risk management software Opture® (Optimize the Future) is a modular and upgradeable system for financial institutions, insurance companies, private equity companies, and industrial companies. Noetzold & Noetzold delivers the system as a web-based Intranet application.

The Opture® system is a fully integrated risk management system that can be gradually upgraded from a bare risk documentation system to a complete risk management system that represents all risk management processes and corporate structures. The benefit of the Opture® system is to standardize (enhance efficiency) and institutionalize the risk management process.

The enterprise-wide risk management system Opture® is structured into four system solutions (Risk Documentation, risk controlling, risk engine, risk management) and three risk management service solutions (profiling, modelling, reporting). The system solutions serve the whole range of user requirements, starting with risk documentation and ending with a highly efficient and complete risk management system solution. This product portfolio enables the user to gradually develop their risk management activities, processes, and applications.

The enterprise-wide risk management system is based on the standardized risk management software solution Opture® (Optimize the Future) providing the following products:

Software:

- Opture® Risk Documentation

- Opture® Risk Controlling

- Opture® Risk Engine

- Opture® Risk Management

Services:

- Opture® Risk Profiling

- Opture® Risk Modelling

- Opture® Risk Management Service

Common Features of all Modules

All modules are based on innovative and state-of-the-art risk management models and methods. In case to the patented high performance Monte Carlo simulator (Opture® Risk Engine) the Opture® Risk Controlling and the Risk Management solutions are able to aggregate risk portfolios of any size with highest precision.

The system solutions Opture® Risk Documentation, Opture® Risk Controlling and Opture® Risk Management contain the following standard features:

- Enterprise-wide access (intranet web application with data base and server).

- Administration (fully configurable access to data and functions).

- Integrated system.

- Individual parameter setting for gross and net calculations.

- Thresholds for monitoring.

- Historic and future development of risks, opportunities, measures, and risk portfolios.

- Automatic import of asset data (risks, opportunities, risk drivers, measures, plan data) from spreadsheets or from client databases, or manual input into web browser.

- Risk data input with scenario method (probability and loss data) or definition of a probability distributions.

- Data export to all standard document formats (e.g. xls, pdf, doc, ppt, csv, jpg, ...).

- Calculations for all slices of risk data: individual risks, opportunities, measures, risk drivers, risk portfolios, corporate units, P&L positions, etc. on all hierarchy levels.

- Individual structure configuration (e.g. flexible changes of corporate structure and/or risk owner can be made ).

- Scenario-based evaluation method (e.g. proper consideration of exchange rate fluctuations or evolutions).

- Multi-currency consistency (e.g. inputs in original currencies, automatic conversion to reporting currency considers all exchange rate evolution scenarios).

The system solution can be supplemented with the following features:

- Report generator.

- Rules and scenarios generator.

- Sign-off process.

- Email messaging.

- Links and documents.

- Early warning system (limit system).

and modules:

- Liquidity Management (incl. monitoring and early warning system).

- Monitoring System (incl. limit system).

- Asset Allocation (incl. portfolio optimization).

- Credit Risk Management.

Opture® Risk Profiling

To ensure high quality of data inputs Noetzold & Noetzold developed a special data collection concept. For risks that have to be estimated, the Opture® Risk Profiling concept can reduce the estimation error of risk quantifications by an order of magnitude (i.e. an estimation error of 100% will be reduced to approx. 10%). The concept contains the following items:

- Multi-dimensional data collection (risk profiler concept).

- Consideration of estimation errors in each evaluation.

- Scenario technology (estimation with best, normal, worst case scenarios).

- Risk catalog (specialized standard risk catalog of approx. 200 risks for several industrial sectors).

- Risk profiler (experienced risk manager of N&N help improving and plausibilizing estimation results).

- Consideration gross/net parameters.

Opture® Risk Documentation

The Opture® Risk Documentation software standardizes the risk management process from the risk data collection to the calculation risk average values for each P&L (profit and loss statement) position. This Risk Documentation software generates efficiency potentials within the data collection process, updating process, and calculation process. The central element is a quantitative risk database that can capture and quantify all types of risks, opportunities, and measures. The risk data are categorized with respect to the following corporate structures:

- Risk Owner.

- Risk Profiler.

- Corporate Units.

- P&L Positions.

- Risk Categories.

In the simplest case, an individual risk portfolio can be defined by slicing through these categories and can be evaluated over a time period from a given start date to a given end date. For example, a risk calculation of all sales risks and/or strategic risks of business unit A in region B of risk owner C with P&L effect D can be made. Different levels of gross and net risk exposures can be distinguished by quantification and evaluation parameters (e.g. P&L weights, growth rates, plan coverage).

The results of Opture® Risk Documentation are

- Quantitative risk database.

- Structured and categorized risks, opportunities, and measures.

- Risk-adjusted P&L statement (averages only).

- Gross and net risk average values aggregated on each hierarchical level for each corporate unit and P&L position.

- Probability distribution of risks, opportunities, and measures

- Monitoring risks, opportunities, and measures.

- Risk map and risk table (risk ranking lists).

- Risk report (incl. graphics).

Opture® Risk Modelling

The Opture® Risk Modelling is a risk management service from N&N that develops new or improves existing risk management models. The general aim is to provide a faithful and robust representation of actual risks and to integrate these into existing risk management environments.

The benefits are:

- Transparency and faithful representation of risks.

- Forward-looking information predicting likely outcomes under certain conditions (implementable e.g. in a monitoring or controlling system).

- Precise quantification of risks and of the risks' dependence on underlying factors.

- Basis and prerequisite for an optimal hedging strategy.

On request, N&N also develops customized hedging strategies and assists in implementing these hedges.

For financial institutions and insurance companies we develop specialized risk models for all main risk categories:

- Operational risk models.

- Market risk models.

- Strategic risk models.

- Credit risk models.

For industrial companies we develop specialized risk models for:

- Business process risks.

- Liquidity risks.

- General conditional risks: risks with varying impact depending on the evolution of one or more underlying factors and/or additional constraints, e.g. option models, ranging from standard 'plain vanilla' options to exotic options.

- Default risks: event risks that depend on the evolution of one or more underlying factors, e.g. option models, such as credit risk models.

Opture® Risk Engine

Opture® Risk Engine is a high-performance high-precision Monte Carlo simulator for risk aggregation. An aggregation of a relatively small portfolio of hundreds of risks requires evaluation over orders of magnitude more scenarios than there are atoms in the universe. The Opture® Risk Engine achieves this within a few seconds and with a precision better than one per mille.

The Opture® Risk Engine can be integrated into risk management environments to introduce aggregation functionality (e.g. for Risk Documentation solutions) or to improve performance and/or precision of existing aggregation methods.

Opture® Risk Controlling

The Opture® Risk Controlling is the Opture® Risk Documentation solution with an extended range of functionality and results, in particular, with a risk aggregation engine that considers the full information contained in probability distributions and correlations of risks, opportunities, and measures. Given the full probability information, it can calculate all risk figures (VaR, Expected Loss, quantiles, RaC, RAROC, etc.) and can evaluate individual scenarios (e.g. impact on net income of a x% price increase of raw material A and a y% price decrease of raw material B). Opture® Risk Controlling is the basis for proper risk management because it considers risk correlations and risk dependencies and delivers the basic risk figures necessary for decisions under uncertainty.

The additional results calculated by Opture® Risk Controlling for all risks, opportunities, measures, and risk portfolios based on proper risk aggregation are:

- Risk figures (Sigma, VaR, Expected Loss, quantiles, RaC, RAROC, etc. for all levels of confidence) as a result of proper risk aggregation.

- Diversification and concentration effects.

- Probability densities and cumulative probability distributions.

- Risk-adjusted profit and loss statement.

- Risk-adjusted cash flow statement.

- Risk-adjusted balance sheet.

- Sensitivities, concentrations, correlations.

- Monitoring risk developments (with consideration of risk limits and measures).

- Risk dependencies.

Opture® Risk Management

The Opture® Risk Management is the Opture® Risk Controlling solution with an extended range of functionality and results, in particular, including market data and corporate data as factors. Risks, opportunities, and measures are now dependent on these factors which provides the basis for a dynamic risk management responding to market movements and corporate changes. The risk aggregation now includes the factors, i.e. the simulation evaluates all future scenarios consistent with the probability distribution of the factors (where the future probability distributions are be estimated from historic data using well-established formulas from financial mathematics). With the integration of corporate and market factors it is also possible to optimize risk steering and risk management (e.g. risk-return optimization).

The additional results calculated by Opture® Risk Management for all risks, opportunities, measures, and risk portfolios based on proper risk aggregation are:

- Risk return positioning and optimization (incl. efficient frontier).

- Risk and factor sensitivities.

- Risk-adjusted resource allocation.

- Historic and future risk developments.

The market data are provided by Noetzold & Noetzold, corporate data can be imported from client databases or are updated manually.

Opture® Risk Management Service

The Risk Management Service of Noetzold & Noetzold delivers customized quarterly risk management reports based on the output of Opture® Risk Controlling and Risk Management. The risk reports include detailed analyses of main results, suggestions for efficient risk mitigation measures, and presentations for the board and/or management. The results of the Opture® Risk Management Service are:

- Quantitative risk data collection with experienced risk managers from N&N (e.g. high data input quality, creation of a risk data base).

- Risk aggregation and simulations with Opture® risk management software.

- Calculation of all risk figures, detailed analyses, and suggestions for optimal risk mitigation.

- Customized risk reports and presentations.