Opture® is The Leading Enterprise-wide Risk Management System

The Opture® (Optimize the Future) system is the leading enterprise-wide corporate risk management system, developed and distributed by Noetzold & Noetzold. It implements risk management processes and structures in agreement with world-wide risk management and corporate governance standards. It is designed to satisfy the needs from small to large companies with arbitrarily complex or rapidly changing corporate structure. It unifies standard documentation and monitoring requirements with aggregation and simulation requirements for a comprehensive enterprise-wide risk management.

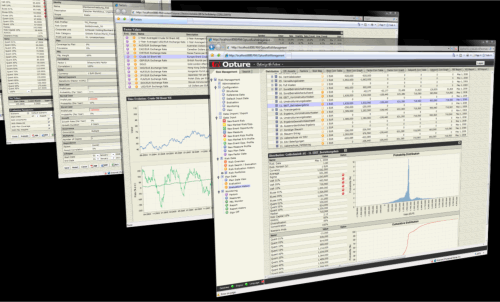

The Opture® system as a web application is compatible with virtually all corporate IT environments. It only requires an intranet or internet infrastructure with web server and database. This means: low implementation costs, low maintenance costs, high accessibility, and high scalability. Eligible corporate users can access the Opture® risk management system through their standard web browser. Alternatively, users can import/export data from/to spreadsheets or use the spreadsheet based Risk Profiler Tool for offline risk data collection (with subsequent online synchronization).

Risk quantification with minimal estimation errors (based on methods developed by Noetzold & Noetzold) and precise fast risk aggregation are essential features of the Opture® risk management system. Standard risk averages alone reflect only part of the picture, in the same way as an average of 7 reflects only part of the result of throwing a pair of dice. Risk is conventionally defined as the deviation from an expectation. A correct risk statement should therefore consider also fluctuations or scenarios beyond the average. The deviations from the average are quantified by risk figures such as volatility, Value-at-Risk, quantiles, probability distributions, etc. For example, a pair of dice has an 8% risk (or chance) of throwing a sum of 10 or more. The evaluation of all possible correlated or uncorrelated fluctuations (i.e. probability distributions) of all risks and all driving factors is called risk aggregation.

Risk aggregation is not as trivial as one might imagine at first. Extending the above example slightly, just a dozen dice have already about 2 Billion (6^12) possible outcomes or scenarios, with the scenario sums ranging between 12*1=12 and 12*6=72. In practice, about 100 risks already lead to more impact scenarios than there are atoms in the universe.

A proper enterprise-wide risk aggregation requires (1.) advanced models to capture and value the diversity of existing risks and (2.) a performant Monte Carlo engine that can aggregate a large number of these risks with a precision necessary to obtain meaningful risk figures, especially for extreme (i.e. rare) events, e.g. for the Value-at-Risk (VaR) at 95%, 99%, or 99.9% confidence. The Opture® system unifies these aspects of enterprise-wide risk management within a single platform.