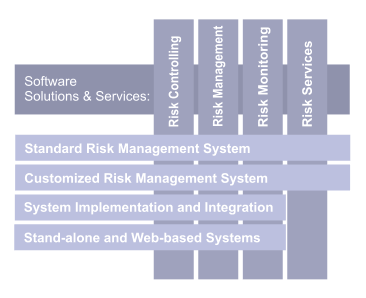

Enterprise-wide and Best Practice Solutions

Noetzold & Noetzold is market and technology leader of strategic enterprise-wide risk management systems. We offer best practice corporate risk management software and consulting services.

Risk Controlling: Risk-adjusted Operational and Strategic Planning

Noetzold & Noetzold developed the risk management software Opture® (Optimize the Future), which has become the leading enterprise-wide risk management solution for corporates.

The risk controlling system from Noetzold & Noetzold enables clients to:

- Reduce volatilities in operational and strategic planning values and guarantee continuous business to investors.

- Enhance shareholder value with implementation of a professional risk management system which ensures optimal risk mitigation.

- Identify and reduce/manage risk bundles (= correlated risks with simultaneous occurrence and extremely high impact/loss).

- Calculate risk premia for a risk-adjusted pricing, risk-adequate strategy development, and risk-adjusted resource allocation.

- Reduce risk costs by defining optimal risk measures and by early warning for threatening risk events and factor dependencies.

- Reduce capital costs by improved corporate rating and risk-return positioning in international markets.

- Optimize risk costs by portfolio optimization.

- Monitor all changes of individual risks and risk portfolios with early warnings. (Note: The risk value of a portfolio can change due to changes in the risk drivers or factors while the risk values of the individual risks remain constant.)

- Increase transparency on risk positions by calculating and monitoring risk figures for Profit & Loss positions, risk categories, corporate units, etc.

The risk controlling system from Noetzold & Noetzold contains:

- Correct risk aggregation with consideration of all risks, opportunities, risk measures, risk drivers, and all mutual correlations.

- Consistent and coherent risk models that cover different risk types.

- Definition and calculation of customized risk portfolios beyond the "slice and dice" portfolios (multi-functional and multi-dimensional risk aggregation).

- Fastest high-dimensional Monte Carlo simulator guarantees precise risk aggregations for all portfolio sizes.

- Monitoring and reporting of all risk results, limits, and volatilities.

The risk controlling system from Noetzold & Noetzold calculates the following risk results for all risk portfolios:

- Probability distributions and cumulative distributions.

- Risk figures (VaR, CFaR, EaR, RORAC, RAROC, RaC, quantiles, Expected Loss, Median, Sigma, etc.).

- Risk-adjusted Profit and Loss statement (with all P&L positions).

- Risk bundles (= correlated risks with simultaneous occurrence and large impact/loss) and diversification effects (= cancelling risks).

- Risk-adjusted operative and strategic planning.

- Sensitivities, risk exposures, risk contributions, risk concentrations.

- Risk rankings, risk maps

Risk Management: Optimization of Risk-Return Position

Conventional management aims to maximize the return/profit (net income). However, high return usually means high risk (Markovitz, CAPM). The aim of efficient risk management is to optimize the risk and return position, i.e. to achieve maximum return at minimum risk, e.g. by proper diversification. The optimization requires correct aggregation of all risks and opportunities, including the effects of risk measures, risk drivers, and correlations. The correlations play an essential part since they determine the priced risk (systematic risk, e.g. market risk) and idiosyncratic risk (unsystematic risk). Normally idiosyncratic risks should be eliminated by optimization since they do not yield premia for the risks taken. Systematic risks carry risk premia (beta) that can be related to the return of a portfolio, i.e. of an investment, corporate unit, etc. The resulting risk-return matrix shows risks and returns of the portfolios where optimal investments are positioned on an efficient frontier or capital market line.

The risk-return position is the key benchmarking measure when allocating capital among investment alternatives, especially for:

- Optimal resource allocation.

- Portfolio optimization.

- Risk-return position of companies, corporate units, subsidiaries, investments, products, etc.

The risk management system from Noetzold & Noetzold determines and delivers the following risk results:

- Risk-return benchmarking.

- Optimal selection of alternative investments (also projects, acquisitions, etc.) under risk-return aspects.

- Risk-adjusted pricing.

- Risk-adjusted strategy.

- Risk strategy.

Risk Monitoring and Reporting: Reliable Real-Time Monitoring Triggered by Internal and External Factors

The risk monitoring of the risk management system Opture® is based on a forward-looking and early warning system that alerts the risk manager when risk limits are violated or are likely to be violated in the near future. A violation of risk limits usually will happen when installed risk measures expire or when market conditions change so that net exposures will occur.

Important for real-time monitoring is the information and the models converting available information into reliable precise forecasts. Of course, it is generally not possible to make predictions without uncertainties about the exact outcome. The forecasting module simulates possible future events and calculates the probabilities for future scenarios based on the information provided. The values of monitored portfolios are evaluated for all scenarios. If at some in time limit violating scenarios become more frequent, i.e. the probability of future limit violations increases, and the alert level is reached, the monitoring system will send an alarm.

Currently Opture® system uses information from external and internal factors. External factors are market data, e.g. exchange rates, commodity prices, share prices, or sector data. Internal factors are indicators that quantify the state of business of the corporation, e.g. sales volumes, production indices, or quality indices. A reliable forecasting needs to model the risks in terms of these factors so that predictions with sensible uncertainties result.

The monitored items can be P&L positions of corporate units, key performance indicators (KPI), key risk indicators (KRI), or any other portfolio with risks. Important for analyzing risk value changes is the ability to calculate and store historic and future aggregation and simulation results at present time.

The monitoring module of the Opture® system possesses a messaging module, which can instantly inform risk managers by email or sms.

The risk reporting module of the risk management software Opture® contains standard reports and individually configurable reports. For further formatting or handling, the results can also be exported in standard document and spreadsheet formats.

Risk Management Service: Risk Management Reports Quarterly

As an alternative to the Opture® system, Noetzold & Noetzold offers a reporting service that provides quarterly risk management statements. The statements are based on regular risk profilings and evaluations with the Opture® risk management software and contains the following figures:

- Calculation of individual risk figures (VaR, CFaR, EaR, RAROC, RaC, quantiles, Expected Loss, Median, Sigma, etc.) for corporate units, subsidiaries, business units, holding.

- Calculation of risk-adjusted P&L statement.

- Calculation of risk-return position.

- Special risk analyses.

- Calculation of risk and factor sensitivities, contributions, and concentrations.

- Risk aggregation of individual risk portfolios, single risks, and risk portfolios on holding level.

- Impact of risk mitigation measures onto KPIs (e.g. earnings, cash flow).

- Risk bundle and diversification effects.

- Calculation of future risk positions (e.g. 5-10 year risk planning).

- Calculation of risk rankings and risk maps.