Efficient, Consistent, and Holistic Risk Management Concept

Added Value Approach

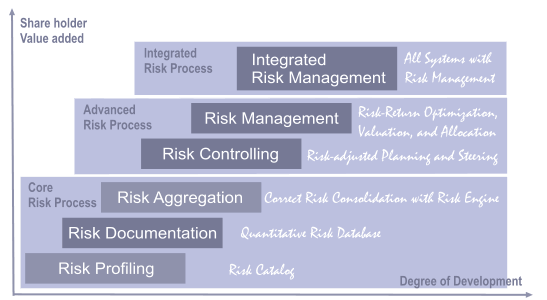

Noetzold & Noetzold has developed a concept for gradual development of the clients' risk management systems. The concept focuses on shareholder value, success factors, and process integration. Noetzold & Noetzold offers an extensive portfolio of consulting services and state-of-the-art software solutions, in line with the main three risk processes: Core Risk Process, Advanced Risk Process, Integrated Risk Process.

Core Risk Process

The core risk process consists of:

- Identification and quantification of risks, opportunities, risk drivers, measures, correlations (e.g. systematic and consistent asset identification and quantification with experienced risk profilers).

- Aggregation of risks, opportunities, risk drivers, measures, correlations (e.g. use of professional risk management software based on correct risk models and methods, requires high-performance Monte Carlo simulator).

- Design risk management organization and processes (e.g. organizational implementation with minimum personnel and efficient process integration).

- Risk reporting (e.g. consideration of risk bundles and diversification effects, calculation of correct and precise risk results).

Typical questions that will be answered by the core risk process are:

- What is the risk exposure?

- What are the costs for risk mitigation?

- Are all risks being managed and mitigated and is management optimal and suitable?

- What is the probability to lose planned earnings or liquidity?

- What is the required economic capital? Is there adequate cover for risk events?

- What are the values for the key risk indicators (KRI)?

The core risk process establishes the database and the structures for the advanced risk processes.

Advanced Risk Process

The advanced risk process consists of:

- Risk controlling (e.g. integration into operational and strategic planning, risk-adjusted Profit and Loss statement, risk results for individual risk portfolios).

- Risk management (e.g. management / steering under risk-return aspects, optimal resource allocation, portfolio optimization).

Typical questions that will be answered by the advanced risk process are:

- What is the risk appetite and how does it align with strategy and business plan? What is the optimal risk strategy?

- How should the resources be allocated and budgeted to optimize the risk-return position? What is the risk-adequate capital budget?

- How should actionable and acceptable limits be constructed? How should they be broken down the corporate hierarchy?

- What is the optimal corporate strategy under risk-return aspects? What competitive advantages can be generated?

- What would be a suitable risk strategy?

- Is liquidity endangered? Are there potential risk bundles (= correlated risks with simultaneous occurrence and extremely high losses)?

- How large are the risk-adjusted (planned) P&L positions and how large are possible deviations (uncertainties, volatilities)?

Integrated Risk Process

The integrated risk process consists of:

- Integration of risk management into conventional management systems (e.g. integration into liquidity or cash flow management, product management, ALM (asset liability management), credit risk management or claim management, M&A, project management).

- Integration of risk dimension into the decision-making procceses.

- Integration of existing individual risk management systems and processes into a coherent enterprise-wide framework.

- Implementation of an enterprise-wide risk management system.

Typical questions that will be answered by the integrated risk process are:

- How can risk-return performance measurement and benchmarking support operational and strategic decisions?

- What is an optimal enterprise-wide allocation and budgeting solution consistent with corporate strategy and risk strategy?.

- How to make decisions under uncertainty consistent with corporate strategy and risk strategy?