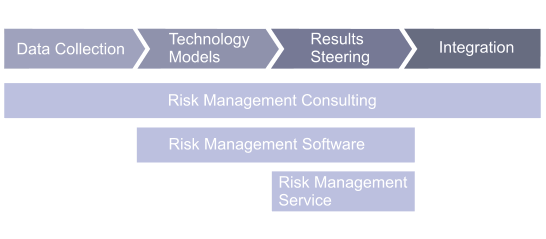

Value Chain based Methodology

The methodology from Noetzold & Noetzold for risk management integration is based on the process flow of risk management and the success factors of risk management. The value chain starts with data collection and ends with the integration of the risk dimension into conventional decision making processes. The product portfolio from Noetzold & Noetzold covers each value chain step up to full integration.

Risk Data Collection

Noetzold & Noetzold has developed an efficient methodology for risk data collection that guarantees high data input quality. The risk data collection process contains:

- Multi-dimensional data collection.

- Scenario method (e.g. best case, normal case, worst case).

- Quantification and valuation (e.g. losses/returns and probabilities).

- Consideration of different risk types (e.g. event risks and market risks).

- Consideration of estimation errors.

- Experts (e.g. experienced risk profiler).

- Risk catalog and risk data base.

- Quantification parameters for differentiation between gross and net risk effects.

This is only a brief list of main topics.

Risk Aggregation / Risk models

Noetzold & Noetzold is the expert for developing and implementing enterprise-wide corporate risk management models with risk aggregation. Risk management models and Monte Carlo simulator are the key ingredients for correct risk aggregation and reliable risk results. Sensible results can only be obtained with consistent risk models and high-performance high-precision Monte Carlo simulators. Requirements should be:

- Risk management models and methods based on well-established formulas from financial mathematics.

- Coherent risk models for different risk types (e.g. event risks and market risks).

- Risk aggregation considering all correlations among risks, opportunities, risk drivers, and measures.

- Vertical and horizontal risk aggregation of complete risk portfolios (i.e. typically with thousands of risks) without any approximations.

- High-performance high-precision Monte Carlo simulator.

- Integrated enterprise-wide risk management system..

- Risk monitoring and early-warning system.

- Enterprise-wide risk and risk factor database.

Risk Results

With the Opture® risk management systems from Noetzold & Noetzold risk results can be calculated for any portfolio over risks from corporate units, functions, risk owner, subsidiaries, regions, projects, investments, strategies, etc. Risk results consists of:

- Risk-adjusted P&L statement and/or balance sheet.

- Risk figures (e.g. Sigma, VaR, CFaR, EaR, RaC, RAROC, RORAC, Expected Loss, quantiles, probability distributions).

- Diversification effects and risk bundles (= correlated risks with simultaneous occurrence and extreme losses), risk ranking, risk maps.

- Risk and risk driver concentrations, contributions, and sensitivities.

- Risk-return matrix and optimization.

- Optimal risk mitigation measures on single risk and on holding level.

- Thresholds for limit system.

- Monitoring of single risks, risk portfolios, risk drivers, risk-adjusted P&L positions, KRI, etc.

These risk results constitute the standard content for corporate risk reporting.

Integration

In order to capture the benefits of an effective risk management, it must be integrated into the strategy and business processes. In a volatile world, risk management is a valuable differentiator that uncovers and utilizes premia associated with risk. The consulting of Noetzold & Noetzold for corporates draws on its professional, methodological, and technical experience in all aspects of risk controlling, risk management, liquidity management, strategy, forecasting, monitoring, hedging, and trading. Some aspects of risk management integration are:

- Implementation of enterprise-wide risk management strategies, models, methods, processes, and systems.

- Integration of risk figures into management information system and reporting.

- Integration of individual risk management systems and processes into a coherent enterprise-wide framework.

- Optimization of the existing processes, methods, and models, specifically targeting consistency and enterprise-wide coherency.

- Coherent representation of interrelated and enterprise-wide risks by the Opture® risk management system.

- Development of enterprise-wide market data management, market database, and calculation of derived quantities (e.g. customized indices, covariances, volatilities, covariances).

The benefits of enterprise-wide risk management are:

- Transparency on and control over corporate risks and exposures to risk factors.

- Monitoring, simulation, and forecasting of risks and risk factors.

- Stable planning data due to reduced exposures to risk factor volatilities.

- optimized risk-return position for given risk strategy.

- Realized premia from proper diversification and portfolio optimization.

- Basis for reliable decisions under uncertainty.

- Coherent methods and processes for all enterpise-wide risks and their interrelations.

- Enhanced efficiency due to unified methods and processes.

- Enhanced diversification due to global, enterprise-wide scope covering also interrelations between different risk models.

- Enterprise-wide market data management and market database