Enterprise-wide and Best Practice Solutions

Noetzold & Noetzold is market and technology leader of strategic enterprise-wide risk management systems. We offer best practice corporate risk management software and consulting services.

Creating New Perspectives: Value-based Management under Risk and Return Aspects

Innovative and value-based companies seek the integration of risk dimensions into their decision making processes, e.g. risk-adjusted planning, risk-adequate strategy development, and risk-adjusted evaluation of investments. Our clients generate benefits from valuations extending into the risk dimensions. Valuations and optimizations that are solely based on returns ignore the additional value that can be raised by proper consideration of risk premia associated with uncertainties in future developments.

Risk management consulting from Noetzold & Noetzold enables corporates to:

- Enhance competitve advantages.

- Enhance corporate performance.

- Optimize resource allocation.

- Reduce costs and increase earnings.

- Quantify and value decisions under uncertainty.

- Quantify and value possible future developments.

- Reduce operative and strategic volatilities.

- Enhance efficiency.

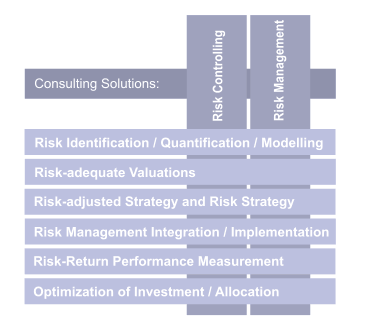

Risk consulting themes from Noetzold & Noetzold are:

- Calculation risk-adjusted Profit and Loss statement, cash flow statement, balance sheet.

- Calculation risk figures (VaR, CFaR, EaR, RORAC, RAROC, RaC, quantiles, Expected Loss, Median, Sigma, etc.).

- Optimization of risk-return position and risk-adequate resource allocation.

- Risk-adequate strategy development (e.g. growth strategy, product strategy, investment strategy, etc.).

- Risk strategy development (under consideration of individual risk appetite).

- Portfolio optimization.

- Risk-adjusted operative and strategic planning.

- Sensitivities and corporate impact of factors and factor volatilities.

- Optimization of corporate performance under risk-return aspects.

- Individual risk modules (operational risk models, credit risk management, etc.).

- Risk controlling and risk management.

- Implementation of risk management system / software.

- Institutionalization of risk management structures (processes and organization).

- Evaluation of investments (e.g. M&A, strategies projects, processes, product launches) under risk-return aspects.

- Risk identification and quantification with efficient methods to guarantee high data quality.

- Risk adjusted pricing.

- Integration of risk management into conventional management systems (e.g. liquidity management, asset liability management, finance, claim/credit management).

- Implementation of risk management into processes and organizational structure.