Noetzold & Noetzold Supports Banks in Risk Management and Value-based Management to Enhance Efficiency

The methodological requirements for banks are continuously increasing due to new legal frameworks, shifting market conditions, and due to global, more competitive landscape. Noetzold & Noetzold develops and implements practical solutions to meet the banking industry´s requirements. We support our clients in the following areas:

- Development and implementation of processes, methods, and models for enterprise-wide risk management.

- Development and implementation of processes, methods, and models for operational risk management.

- Valuation of financial derivatives and structured portfolios.

- Valuation of credit default risks with associated risk premia (risk-adjusted pricing).

Enterprise-wide Risk Management

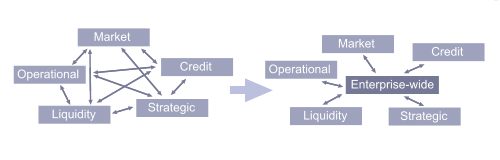

Risk management is the core competence of successful banks. Therefore many banks possess advanced risk management processes and systems covering many types of risks. From the global, enterprise-wide perspective, however, often the different specialized systems and processes are not seamlessly integrated. Deficiencies appear when the interrelations between different types of risks are considered. Credit risks, market risks, liquidity risks, operational risks, etc. usually depend on each other, but these global relations are very often inadequately represented by specialized risk management systems. Since systematically correlated risk events are the main driver for risk management, these interrelations are the main target of global, enterprise-wide risk management.

Noetzold & Noetzold provides the following services for enterprise-wide risk management:

- Identification and improvement of weaknesses in enterprise-wide risk management systems and processes.

- Integration of individual risk management systems and processes into a coherent enterprise-wide framework.

- Optimization of the existing processes, methods, and models, specifically targeting consistency and enterprise-wide coherency.

- Coherent representation of interrelated and enterprise-wide risks by the Opture® risk management system.

The benefits are:

- Coherent methods and processes for all enterpise-wide risks and their interrelations.

- Enhanced efficiency due to unified methods and processes.

- Enhanced diversification due to global, enterprise-wide scope covering also interrelations between different risk models.

Operational Risk Management

Noetzold & Noetzold has developed novel methods to quantify and model operational risks. The quantification requires efficient and coherent profiling of risks, the measurement or estimation of the risks' impacts and probabilities, and modelling to represent characteristic and dynamic features of the risks.

The modelling uses coherent model framework that can cover all enterpise-wide of operational risks, their interdependencies, and interdependencies with other risk types. Noetzold & Noetzold has expertise in modelling specific business processes and in integrating these models into the operational risk process.

The quantification also covers those risks that hitherto have been considered too difficult to quantify. For these cases the parameter estimation includes multiple estimates from different profilers which greatly reduces the overall estimation error. Furthermore, all estimation errors are retained throughout the quantification and aggregation process, further reducing the influence of estimation uncertainties in the final aggregated results (mathematical 'Law of large numbers').

Noetzold & Noetzold offers the following services:

- Quantification of operational risks (identification, measurement, modelling).

- Coherent modelling of operational risks.

- Customized modelling of business processes.

- Complete representation of all enterprise-wide operational risks by the Opture® risk management system.

The benefits are:

- Transparency on and control over operational risks.

- Coherent model for all enterprise-wide operational risks and their interrelations.

- Coherent implementation of all enterprise-wide operational risks and their interrelations.

Credit Risk Management

Credit risks depend primarily on the creditworthiness of the individual debtors. Evaluating the default probability attached to individual debtors and taking into account correlations in the receivables portfolio, enables corporates to evaluate and manage these risks.

A number of new products facilitating the management of credit risks have appeared on the market over the past few years, e.g. credit derivatives, securitizations, CDOs etc. These products are valuable as long as their inherent risks are dominated. Proper risk management should consider the derived risks that arise from such products (see subprime crisis).

Noetzold & Noetzold supports their clients in all stages of the risk management process:

- Valuation of credit default risks with associated risk premia (risk-adjusted pricing).

- Development of risk strategies.

- Definition and optimization of claim management processes.

- Determination of default probabilities and default correlations.

- Monitoring, simulation, and forecasting of risks and risk factors.

- Optimization and management of credit portfolios.

- Development and optimization of hedging strategies.

- Valuation of credit derivatives.

The benefits are:

- Transparency on and control over credit exposures and receivables value due to calculation of inherent risk premia.

- Improved risk-adjusted pricing of receivables.

- Stable credit portfolio values due to hedging.

- Realized premia from proper diversification and portfolio optimization.