Noetzold & Noetzold Enables Corporates to Optimize their Risk-Return Position and Enhance Earnings

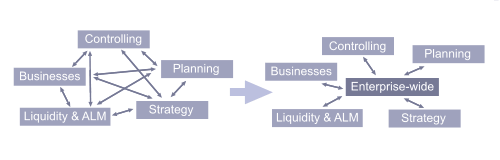

In order to capture the benefits of an effective risk management, it must be integrated into the strategy and business processes. In a volatile world, risk management is a valuable differentiator that uncovers and utilizes premia associated with risk. The consulting of Noetzold & Noetzold for corporates draws on its professional, methodological, and technical experience in all aspects of risk controlling, risk management, liquidity management, strategy, forecasting, monitoring, hedging, and trading, which are covered by the corporate departments:

- Strategy.

- Financial Services (treasury, ALM, liquidity, commodities, exchange Rates, pension funds, etc.).

- Corporate Risk Management.

- M&A.

Noetzold & Noetzold provides customized solutions for the following issues:

Enterprise-wide Risk Management

Noetzold & Noetzold supports clients in developing their corporate risk management with state-of-the-art models and methods.

Noetzold & Noetzold has developed an efficient and coherent risk data collection process that covers all enterprise-wide risks. This process in particular improves the profiling of risks that hitherto have been considered too difficult to quantify, e.g. strategic and reputation risks. For these cases the quantification process includes multiple estimates from different profilers which greatly reduces the overall estimation error. Furthermore, all estimation errors are retained throughout the quantification and aggregation process, further reducing the influence of estimation uncertainties in the final aggregated results (mathematical 'Law of large numbers'). The whole process guarantees precise risk figures that also cover risks that hitherto have been considered too difficult to quantify.

Noetzold & Noetzold has also developed a high-performance high-precision Monte Carlo simulator that is capable to aggregate thousands of risks in seconds to per-mille precision. Exceptional Monte Carlo performance is an important determinant of professional risk management, since about 100 risks already lead to more impact scenarios than there are atoms in the universe (see 'System').

Noetzold & Noetzold delivers the following services:

- Implementation of efficient enterprise-wide risk management processes.

- Integration of risk management processes into existing processes (e.g. integration into operational and strategic planning or consolidation of all enterprise-wide risk management processes).

- Risk management process reengineering, redesign, and optimization.

- Development and optimization of risk management structures.

- Integration of risk management structures into company's organizational structure (e.g. in case of post merger integrations).

- Risk identification, quantification, and aggregation.

- Risk controlling and risk management.

- Portfolio optimization and determination of diversification effects.

- Integration of risk figures into management information system and reporting.

- Implementation of enterprise-wide risk management strategies, models, methods, and systems.

- Development of risk strategies within the corporate strategy.

- Determination and optimization of risk-return positions given the risk strategy.

- Valuation and benchmarking of client's system with best practise solutions.

- Identification and improvement of weaknesses in enterprise-wide risk management systems and processes.

- Integration of individual risk management systems and processes into a coherent enterprise-wide framework.

- Optimization of the existing processes, methods, and models, specifically targeting consistency and enterprise-wide coherency.

- Coherent representation of interrelated and enterprise-wide risks by the Opture® risk management system.

- Development of enterprise-wide market data management, market database, and calculation of derived quantities (e.g. customized indices, covariances, volatilities, covariances).

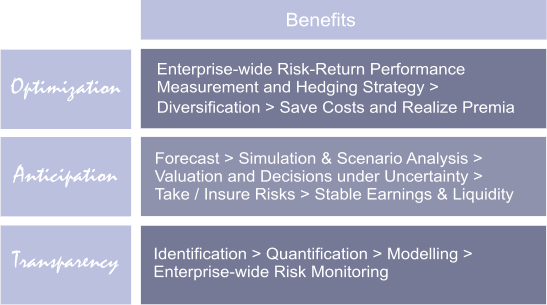

The benefits of enterprise-wide risk management are:

- Transparency on and control over corporate risks and exposures to risk factors.

- Monitoring, simulation, and forecasting of risks and risk factors.

- Stable planning data due to reduced exposures to risk factor volatilities.

- optimized risk-return position for given risk strategy.

- Realized premia from proper diversification and portfolio optimization.

- Basis for reliable decisions under uncertainty.

- Coherent methods and processes for all enterpise-wide risks and their interrelations.

- Enhanced efficiency due to unified methods and processes.

- Enhanced diversification due to global, enterprise-wide scope covering also interrelations between different risk models.

- Enterprise-wide market data management and market database

Risk-adjusted Planning (Forecasting, Simulation, and Planning)

Noetzold & Noetzold integrates the risk dimension enterprise-wide into operational and strategic planning processes.

For efficient and risk-adjusted planning Noetzold & Noetzold evaluates future scenarios derived from current market price data (e.g. from future values, option prices, price volatilities) and scenarios derived client's plan data and client's objective functions or constraints. Risk and risk factor sensitivities and exposures analyses show the weaknesses and strengths of client's operative and/or strategic planning and the degree and composition of risk contained in client's businesses. Especially in volatile markets corporates need to know the scenarios and the likelihood of scenarios that can jeopardize planned earnings and/or their liquidity.

Noetzold & Noetzold delivers the following results to optimize the risk-adjusted planning:

- Risk-adjusted profit and loss statement.

- Risk-adjusted cash flow statement.

- Risk-adjusted balance sheet.

- Determination of risk exposures and risk factor exposures.

- Determination sensitivites, contributions, and concentrations.

- Forecasts and scenario simulations under objective functions specified by customers.

- Calculation of risk figures (VaR, sigma, RAROC, Expected Loss, etc.).

- Calculation and optimization of economic capital.

- Development of risk strategies.

The benefits of risk-adjusted planning are:

- Transparency on and control over corporate risks and exposures to risk factors.

- Monitoring, simulation, and forecasting of risks and risk factors.

- Stable planning data due to reduced exposures to risk factor volatilities.

- optimized risk-return position for given risk strategy.

- Realized premia from proper diversification and portfolio optimization.

- Basis for reliable decisions under uncertainty.

Risk-adjusted Strategy and Risk Strategy

Noetzold & Noetzold integrates the risk dimension into the corporate strategy and decison making processes. This 'risk-adjusted strategy' extends conventional strategy with the effects of uncertainties and associated risk premia that are connected with decisions based uncertain future developments.

Given an analysis of the risks, opportunities, and associated premia, the risk strategy determines the objectives of risk management, i.e. which risks to take, which risks to insure, or where to allocate resources. For example, for an industrial company, the aim is often to take risks in the area of its expertise and to hedge exchange rate or commodity risks (i.e. leave these to experts in the financial markets).

Noetzold & Noetzold develops customized risk strategies based on the corporate strategy. Many companies are aware of their risk exposures but do not know how much risk to take. Accepting or insuring all risks or treating risks indiscriminately is almost certainly not an optimal risk strategy. The optimal risk strategy lies in between and can be derived from:

- Corporate strategy.

- Risk appetite.

- Risk exposures.

- Diversification potentials.

- Availability of resources.

- Targeted risk-return position.

A closely related topic is risk-adjusted performance measurement. For example, resources (and incentives) should be allocated on a risk-return basis and not just on a return basis. Allocation on return basis would reward business units with high yields and large risks, simply because it does not consider losses on corporate level when a business unit defaults. A business unit has to be charged a risk premium that covers the losses a business unit can create in its corporate environment (which can be regarded as 'insurance premium'). These premia usually depend also on the nature of the businesses (through betas).

The risk strategy can also define the acceptable risk exposures (risk limits) for all business units of the company and can determine risk-adjusted (risk premium based) resource allocation among those business units.

Noetzold & Noetzold delivers the following services to integrate the risk dimension into the corporate strategy and to define an optimal risk strategy:

- Analysis of risks and associated risk premia for corporate strategy and strategic projects.

- Simulation-based evaluations and optimizations of corporate strategies, risk strategies, and strategic projects.

- Definition of risk strategy within the corporate strategy.

- Determination and optimization of risk-return matrix of business units.

- Risk-adjusted performance measurement.

- Development of risk-return based resource allocation among business units.

- Definition of risk limits for business units.

- Definition of targeted risk-return matrix under consideration of risk strategy and objective functions.

The benefits of a risk strategy are:

- Corporate risk strategy defines risk management objectives.

- Corporate risk strategy optimizes risk-return positioning on all corporate levels.

- Corporate risk strategy raises diversification premia on all corporate levels.

- Transparency on and control over business unit risks, risk exposures, and risk-return positions.

- Monitoring of risk limits for business units.

- Risk-return optimized resource allocation among business units for given risk strategy.

- Basis for reliable decisions under uncertainty.

Treasury and Financial Risk Management

Industrial companies are often exposed to risks triggered by financial market fluctuations and default on receivables. These risks have an impact on corporate earnings and liquidity, and, in extreme cases, can even pose a threat to the existence of a company. Financial risks management embraces the management of the following risks:

- Market risks (e.g. interest rate risks, exchange rate risks, stock price risks, commodity price risks).

- Operational risks (e.g. business risks, event risks).

- Liquidity risks.

- Credit risks.

- Reputation risks.

- Strategic risks.

Financial risks management thus requires an enterprise-wide risk management. Corporates can only make executive decisions as to which risks they wish to bear and which risks to avoid if they are in a position to judge the scope of risks in question and the potential impact of the risks in question on planned earnings or liquidity. By employing customized financial products, it is possible to reduce such risks to an appropriate level. Noetzold & Noetzold supports corporates at all stages of the risk management process with tailored solutions:

- Risk identification, modelling, quantification, and enterprise-wide aggregation.

- Modelling of financial risks dependent on business operations and business risks.

- Development and optimization of hedging strategies.

- Management of liquidity risks and minimization of liquidity costs.

- Optimization of asset liability management.

- Valuation of derivatives.

- Structuring customized financial products.

The benefits are:

- Transparency on and control over exposures to market price volatilities.

- Transparency on and control over the relation between business operations and financial figures (e.g. liquidity).

- Stable planning data due to reduced risk factor volatilities.

- Hedged financial risks at minimum costs.

- Basis for reliable decisions under uncertainty.

- Minimized refinancing costs.

Liquidity Risk Management

Liquidity management or liquity risk management aims to protect the liquidity of a business at minimum costs. Liquidity risks embrace all risks that threaten the liquidity of a company. Liquidity management thus requires an enterprise-wide risk management with advanced modelling capabilities but offers large diversification premia. Noetzold & Noetzold provides the following services:

- Modelling of liquidity, in particular, with respect to business operations and market movements.

- Monitoring, simulation, and forecasting of liquidity, liquidity risks, and liquidity risk factors.

- Scenario analysis and stress testing of liquidity models.

- Development of diversification strategies.

- Development of contingent capital strategies.

The benefits are:

- Transparency on and control over liquidity development dependent on business operations and market movements.

- Improved control to manage future liquidity.

- Stable liquidity.

- Managed liquidity at minimum costs.

Commodity Risk Management

Noetzold & Noetzold enables clients to protect their businesses from the negative impacts of commodity price fluctuations. An effective management of risks associated with the uncertainty of future commodity prices is generally cheap due to the abundance and liquidity of traded products. An important prerequisite is a faithful modelling and measurement of corporate exposures. Noetzold & Noetzold provides the following services:

- Quantification and modelling of actual exposures through the whole value chain.

- Scenario simulations for future market scenarios and their impact to key figures and P&L statement.

- Monitoring, simulation, and forecasting of risks and risk factors.

- Development and optimization of hedging strategies.

- Valuation of commodity, weather, and energy derivatives.

The benefits are:

- Transparency on and control over exposures to market price volatilities.

- Stable planning data due to reduced market price volatilities.

- Hedged commodity risks at minimum costs.

- Basis for reliable decisions under uncertainty.

Credit Risk Management

Credit risks depend primarily on the creditworthiness of the individual debtors. Evaluating the default probability attached to individual debtors and taking into account correlations in the receivables portfolio, enables corporates to evaluate and manage these risks.

A number of new products facilitating the management of credit risks have appeared on the market over the past few years, e.g. credit derivatives, securitizations, CDOs etc. These products are valuable as long as their inherent risks are dominated. Proper risk management should consider the derived risks that arise from such products (see subprime crisis).

Noetzold & Noetzold supports their clients in all stages of the risk management process:

- Valuation of credit default risks with associated risk premia (risk-adjusted pricing).

- Development of risk strategies.

- Definition and optimization of claim management processes.

- Determination of default probabilities and default correlations.

- Monitoring, simulation, and forecasting of risks and risk factors.

- Optimization and management of credit portfolios.

- Development and optimization of hedging strategies.

- Valuation of credit derivatives.

The benefits are:

- Transparency on and control over credit exposures and receivables value due to calculation of inherent risk premia.

- Improved risk-adjusted pricing of receivables.

- Stable credit portfolio values due to hedging.

- Realized premia from proper diversification and portfolio optimization.