Risk Aggregation

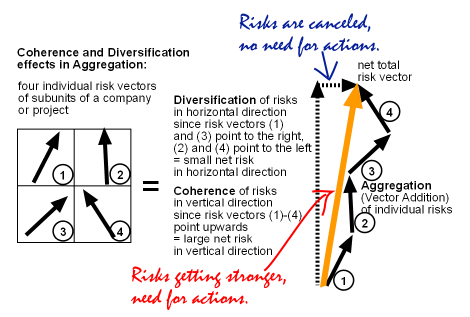

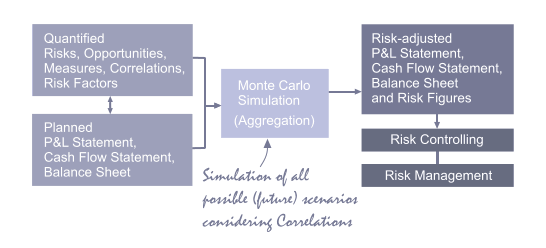

Risk aggregation is an indispensable prerequisite for calculation of correct risk figures. Risks are correctly consolidated by risk aggregation, which is quasi a vector-addition (see graphic), based on Monte Carlo simulations.

Consolidation of Risks: Sample Case

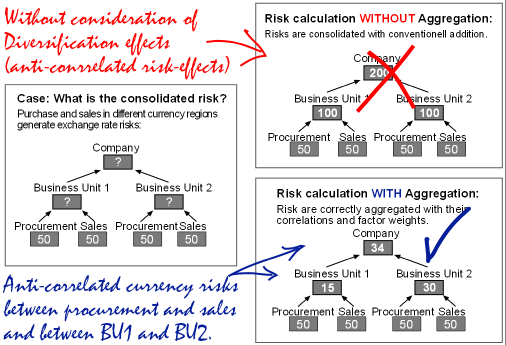

An enterprise consists of two business units (BU), each with purchase and sales departments (see graphic below). The risks in terms of EBIT volatilities are EUR 50 millions per annum. What is the consolidated risk of the company in terms of corporate EBIT volatility?

Intuitive Approach Leads to Incorrect Risk Figures

The intuitive approach would be to add the risks which results in 100 millions EUR for each business unit and 200 millions EUR for the total enterprise. This is the correct result only for the special case when all risk are fully (100%) correlated. However, this is not the case in general, since sales and purchase departments and/or business units always contain some dependencies (i.e. correlations or anti-correlations). In practice one finds almost always diversification effects between purchase and sales and/or business units. The task of risk controlling and risk management is to quantify these effects and to determine the correctly consolidated risk figures.

Correct Aggregation of Risks

The correct risk aggregation needs to quantify the dependencies / correlations between purchase and sales and/or business units. If the risks of purchase and sales are anti-correlated (i.e. negative correlation) due to opposite exposures with respect to exchange rates, these risks cancel to some degree and large diversifications on the level of business units result. (The risks of purchase and sales department in the graphic are correlated with -95.5% und -82%, respectively.) If the two business units act independently and have no common factors, then one can assume that correlations are negligible (i.e. correlations = 0%, as is also assumed in the graphic). One sees that even for no correlations at all diversification effects are sizable. This result shows that proper aggregation with consideration of correlations can lead to diversification effects that can reduce the total risk to 1/6 of the value obtained intuitively by addition of risks.

Diversification Effects and Concentration Effects (Risk Bundles)

The correctly aggregated consolidated risk values can be decomposed into contributions from individual risks and factors. For example, in the discussed sample case, on the business unit level, one will find only a small net contributions of currency or exchange rate risks / factors, since these risks cancel (i.e. diversify) when aggregating the purchase and sales departments. When aggregating the two uncorrelated business units in the sample case, no specific cancellations or enhancements occurred. However, net diversification effects emerge due to unsystematic (i.e. idiosyncratic) fluctuations in the individual (uncorrelated) risks that cancel on average when aggregating over many simulation scenarios. (The same diversification effect reduces the volatility of a portfolio of different stocks compared to the volatility of individual stocks.) Concentration effects occur when risks are positively correlated, i.e. when the individual risks are more likely to happen together, so called risk bundles. In the extreme case of fully correlated risks, all these risks always happen together generating a loss that corresponds to the addition of all risks (in all scenarios and on average). Risk bundles can have severe consequences due to their high impacts.

Results

The following results can be obtained with correct aggregation:

- Diversification effects.

- Risk and risk driver concentration, contributions, and sensitivities.

- Vertical and horizontal consolidated risk figures (e.g. VaR, CFaR, EaR, RaC, RAROC, RORAC, Expected Loss, probability distribution, quantiles).

- Risk-adjusted P&L statement and balance sheet.

- Risk-adjusted key figures (KPI, KRI).

- Risk driver impact to earnings and assets.

- Risk mitigation measures on individual risk and corporate level.